Photo by RDNE Stock project

If you are an active homebuyer browsing for available real estate listings, there has been a time when you may have encountered a stunning property with an attractive price point.

If you find a property that catches your eye with a reasonable price, it’s always worth scheduling a viewing or making an offer.

However, before actually making an offer, there are a lot of things that you should weigh in before finally taking a big leap.

It is essential to have a striking balance between acting quickly and being thorough in your decision-making process.

Becoming a homeowner takes more than being able to pay the down payment and mortgage.

In the realm of real estate transactions, inquiries regarding expenses and requisite fees are commonplace.

Typically, conventional home acquisitions entail upfront payment and closing expenditures, which can drive up the overall cost for the purchaser by a significant sum.

To get the deal done, the buyer and seller often share the burden of paying a percentage of the closing costs and may agree to some adjustments.

If you have decided to push through buying a new residential property, it is vital to have a clear understanding of all associated fees before you can finally have your keys.

Closing fees might be confusing, so before you sign any paperwork for your loan, we’ll review everything you need to understand for you to prepare for closing.

We will also offer suggestions on minimizing closing costs and maximizing your savings when buying a home.

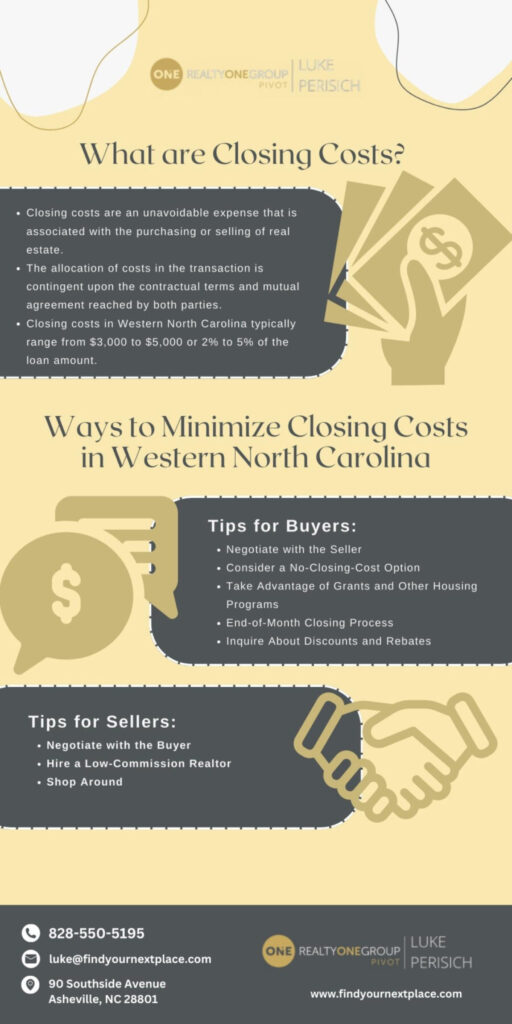

What are Closing Costs?

Photo by Karolina Grabowska

Closing costs are an unavoidable expense that is associated with the purchasing or selling of real estate.

Typically, the responsibility of bearing additional fees and expenses levied by the lender and other third-party entities falls on the homebuyer.

However, it is also possible to negotiate with the seller to shoulder a portion of these costs as part of the home sale agreement.

The allocation of costs in the transaction is contingent upon the contractual terms and mutual agreement reached by both parties.

Some typical closing costs you may encounter include fees for credit verification, loan origination and processing, property inspections, and valuations.

It also encompasses escrow expenses, government taxes, fees, and document preparation fees.

Closing costs in Western North Carolina typically range from $3,000 to $5,000 or 2% to 5% of the loan amount.

These fees adhere to standard statewide guidelines, ensuring buyers and sellers from other states will encounter comparable expenses.

Factors that Affect Closing Costs in Western North Carolina

Photo by Tima Miroshnichenko

A critical aspect of real estate transactions is understanding the closing costs involved. These costs are fees associated with finalizing a property sale.

By familiarizing yourself with these costs and seeking professional guidance, you can avoid surprises and ensure a successful real estate deal.

Let’s look at some of the typical closing costs in Western North Carolina that can significantly affect your financial situation.

Common Closing Costs for Buyers

Photo by Karolina Grabowska

Appraisal Fee

It encompasses the services rendered by a licensed professional to assess the property’s value for sale.

Although categorized as a “closing” cost, appraisal fees can be paid before the closing date.

Typical, in-depth house appraisals in Western North Carolina can cost anywhere from $300 to $450.

Application Fee

Specific lenders may impose a few hundred dollars in processing fees to handle your loan application.

Credit Report Fee

The credit report fee is a typical cost levied by your lender to assess your credit report and rating. The applicable charge for each borrower may range from $30 or higher.

Home Inspection Fee

In addition to the appraisal, it is common to engage a home inspector’s services to assess the property’s condition.

The home inspection fee, typically $300 and up, is paid directly to the inspector for their professional evaluation.

Although an inspection is not mandatory, ensuring that you are fully informed of any potential issues with the property is highly recommended.

Loan Origination Fee

An origination fee is a cost a lender collects at the beginning of the loan process. It can range from at least 0.5% to 1% of the total loan amount.

This fee is the main revenue source for mortgage lenders.

Loan Discount Points

One option to decrease the interest rate on your mortgage is to consider paying mortgage points, also referred to as discount points.

A common practice among lenders is to offer borrowers the option to pay points in exchange for a reduced interest rate. 1% of the loan amount is equivalent to one discount point.

Although this increases your closing costs, it can significantly affect the total interest you pay throughout the loan.

Prorated Property Taxes

Buyers are often expected to pay anything from six months to a full year’s worth of property taxes upon closing. It is an expense that varies in price from one state to the next.

Property tax rates in North Carolina are comparatively lower than those in other states.

Comparatively speaking, North Carolina’s average effective property tax rate of 0.70% is lower than the national average of 0.99%.

Title Search Fee

Your lender will engage a title company to thoroughly search property records to verify the absence of any title-related issues, such as a tax lien.

The cost associated with conducting a title search amounts to approximately $300 and up.

Title Insurance Fee

Mortgage lenders typically require borrowers to secure title insurance to safeguard against potential ownership disputes following the transaction.

Title insurance fees usually incur a cost depending on your home value:

Approximately:

- $100,000 or less: $2.50 per thousand

- $100,000 to $500,000: $2 per thousand

- $500,000 to $2 million: $1.30 per thousan

Underwriting Fee

Underwriting fees may also be referred to as administrative or processing fees, which cover the expenses associated with assessing and validating your financial credentials and eligibility.

The cost structure may either be a fixed rate or a proportion of the loan amount, typically 0.5% of the borrowed sum.

Other Costs Borne by the Buyer

| PARTICULAR | COST |

|---|---|

| Attorney Fees | $700 and up |

| Escrow deposit for property taxes and homeowner’s insurance | $1,000 and up |

| Flood certification (if required) | $18 |

| Homeowner’s insurance; at least 12 months prepaid at closing | $1,000 to $1,500 |

| Land Survey Fees | $350 and up |

| Lender’s title insurance | Approximately:

|

| Postage and Courier Fees | $35 |

| Prepaid daily interest charge — 15 days | $250 |

| Recording Fees for all documents except encumbrances and deeds | $100 |

| Tax Transcript | $20 |

| Termite Report | $85 to $250 |

| Upfront Mortgage Insurance Premium (MIP) for FHA loan if the down payment is less than 20% | MIP = 1.75% of the FHA base loan amount |

Common Closing Costs for Sellers

Photo by Tima Miroshnichenko

Escrow Fees

Escrow fees, commonly referred to as settlement or closing fees, are charges paid to the escrow or title company responsible for overseeing the closing procedure.

The company is responsible for diligently preparing all necessary documents, accurately deducting closing costs from the sale proceeds, and efficiently disbursing the funds on your behalf.

They levy a fundamental charge along with a nominal percentage of the sale price. These fees often vary and are split equally between the buyer and seller.

An escrow company typically charges a base fee of $1,000 in addition to 0.2% of the property’s sale value. The total amount on a property valued at $300,000 would be $1,600.

However, these fees may fluctuate significantly based on the particular services rendered by the company and the intricacy of the sale.

Homeowners Association Fees

If you are a homeowners association (HOA) member, you may be required to remit prorated membership dues upon the completion of the sale.

Prorated Property Taxes

In addition to customary real estate transfer taxes, the seller is responsible for covering any outstanding property taxes.

Typically, the tax bill shall be prorated based on the duration of your property ownership during the year.

To simplify, if you are the property owner for the first six months, you will be accountable for fifty percent of the yearly property taxes.

Meanwhile, the remaining sum of the annual property tax would be the responsibility of the incoming proprietor.

Compared to the national average of 0.99%, North Carolina boasts a lower average effective property tax rate of 0.70%.

Realtor Commission Fees

Real estate commission fees compensate both your agent and the buyer’s agent for their assistance in selling your property.

It is typically the highest expense incurred by sellers at closing.

Typically, real estate agent commissions amount to 5.5% of the property’s sale price, which can exceed your remaining closing expenses.

Since real estate commissions are a sizable portion of the transaction price, comparing rates from different brokers can save you hundreds of dollars at closing.

Seller's Attorney Fee

It is highly advisable to consider the services of an attorney for reviewing your closing paperwork.

It is particularly true in cases where intricate legal matters such as estate sales or outstanding liens are involved, even if it is not mandatory by law.

If you hire a seasoned lawyer to help you sell your house, you may expect to pay between $600 and $1,000.

Note that sellers don’t need to retain legal representation for the purpose of home sales in North Carolina.

Transfer Taxes and Recording Fees

Transfer taxes and recording fees, also known as recordation, documentary, or conveyance fees, are expenses related to the transfer of the property’s legal ownership from the seller to the buyer.

The payment of these taxes may be remitted to either your county or municipal government, depending on your geographical location.

Transfer tax in North Carolina is equivalent to $1 for every $500 of the sales price, while recording fees are about $100.

However, there may also be instances where the buyer is responsible for settling these costs.

Other Costs Borne by the Seller

| PARTICULAR | COST |

|---|---|

| Document preparation | $150 to $300 |

| Excise tax/revenue stamps | $2 for every $1,000 of the sales price |

| Homebuyer’s title insurance | $1000 |

| Postage and courier fees | $35 |

| Title search | $300 to $600 |

Tips for Managing and Reducing Closing Costs in Western North Carolina

Photo by Karolina Grabowsk

Closing costs can be a daunting expense for homeowners in Western North Carolina. However, with a little effort and strategy, managing and even reducing these fees is possible.

Here are some tips to help minimize closing costs and save money during the home-buying or selling process.

Tips for Buyers

Photo by cottonbro studio

Negotiate with the Seller

The allocation of closing costs can vary depending on the contract terms negotiated in the purchase agreement.

It is common for the home buyer to cover certain closing costs, while the seller is responsible for others, including the commission for the real estate agent.

One option available is to request the seller to shoulder some of your portion. This contribution would be documented as “seller credits” on the loan estimate form.

However, this particular strategy may be less effective in a seller’s market, where the seller typically has greater negotiating power.

Consider a No-Closing-Cost Option

If you have to deal with a shortage of liquid funds to cover the closing costs, consider a no-closing-cost alternative.

Your lender typically offers it in return for a relatively higher interest rate. By opting for this option, you can avoid needing upfront payment at closing.

Remember that this may result in higher costs in the long term, as your lender will absorb these expenses while you pay a higher interest rate.

Take Advantage of Grants and Other Housing Programs

Various municipalities, counties, and states offer housing assistance programs for down payments and closing costs to eligible homebuyers, particularly first-time homebuyers.

End-of-Month Closing Process

By closing at the month’s end, you can effectively minimize your cash outlay at closing.

It can be achieved by reducing the days to which the per diem interest is applied before your first mortgage payment is due, typically on the first day of each month.

Inquire About Discounts and Rebates

In mortgage loans, certain lenders may provide incentives to entice potential borrowers.

Take advantage of these rebates to reduce costs by a few hundred dollars.

Tips for Sellers

Photo by Natasha Chebanoo

Negotiate with the Buyer

After finding a real estate agent to represent you, the closing cost reduction opportunity presents itself during the negotiation phase.

Sellers have a lot of leverage in competitive home markets. If you negotiate well, the buyer may be willing to pay more closing costs than is typical in your location.

However, it is not typically the best way to maximize your profit and savings from the sale of your home.

The buyer typically pays closing costs and may not have a large financial reserve. Most purchasers would rather pay for a higher home price than pay more in closing costs.

Hire a Low-Commission Realtor

Hiring a low-commission realtor is the greatest and simplest method to keep more money in your pocket at closing.

The real estate commission is often the largest closing fee when selling a home. For most sellers, even a modest price cut means substantial savings.

Shop Around

You can save money on some closing expenses if you shop around as the closing date approaches.

In real estate transactions, for instance, the buyer typically selects the escrow company, often on the advice of the buyer’s agent or lender.

However, sellers can search for a reputable escrow company that charges reasonable fees and then recommend the company to their prospective purchasers.

Conclusion

Closing costs in Western North Carolina can vary depending on property value, loan type, and location.

It is important for homebuyers to carefully review their closing cost estimate to ensure they are aware of all the charges involved in the home-buying process.

Mortgage closing costs can be frustrating if you aren’t ready for them, but if you do your homework beforehand, you can avoid unpleasant surprises.

Don’t just accept the first rate offered to you by the lender. Instead, browse around and compare rates. There are also different ways to reduce and save on closing costs.

By working with an expert real estate agent, homebuyers like you can confidently navigate the closing process and avoid any financial surprises.

If you are interested in further discussing closing costs, please do not hesitate to call me at 828-550-5195 or email me at luke@findyournextplace.com.

I can also assist you with any real estate-related inquiries you may have or if you would like a tour of one of the neighborhoods in Western North Carolina.

Photo by Karolina Grabowska

Frequently Asked Questions

How much are closing costs in Western North Carolina?

The average closing cost in Western North Carolina ranges between $3,000 and $5,000, or 2% to 5% of the loan amount.

Who pays closing costs in Western North Carolina?

It is often the buyer who bears the responsibility to pay closing costs. However, sellers can also shoulder some costs and make necessary adjustments to close the deal.

What are the closing costs in Western North Carolina?

Some common closing costs in Western North Carolina include appraisal fees, application fees, credit report fees, home inspection fees, loan origination fees, taxes, escrow fees, HOA fees, and attorney and realtor fees.